Uganda Free Zones Authority (UFZA) is a Statutory Body established in line with the East African Community (EAC) Partner States’ Commitment to develop Special Economic Zones. The Authority was set up by the Free Zones Act, 2014, and is responsible for the establishment, development, management, marketing, maintenance, supervision and control of Free Zones for the purpose of creating opportunities for export-oriented investment, export development and Job creation. The Uganda Free Zones Authority is a member of the Africa Economic Zones Organisation, the World Free Zones Organisation and the Global Alliance of Special Economic Zones.

With the adoption of the EAC Special Economic Zones Policy 2023, and the issuance of the Ministerial Regulations 1/2023 regarding treatment of goods produced in Free Zones under the African Continental Free Trade Area, the Authority is committed to quicken the pace of export development and expand Uganda’s share of global trade.

Export development remains essential for Uganda’s economic growth and transformation. Economic activity continues to be concentrated in low value-added activities and exports that offer a limited scope for a qualitative increase in productivity, technology transfer, linkages with global supply chains and job creation. Free Zones offer an opportunity for Uganda to tackle these key challenges in a way that will promote Uganda’s global competitiveness.

A Free Zone is a geographical area (enclave of economic activity) which, under Statutory Declaration, is exempted from customs duties and taxes applicable on importation of inputs and exportation of outputs to aid production of export competitive goods and services. This facilitates trading for development in the age of global value chains.

Free Zones serve as a catalyst for Uganda’s industrialisation agenda and transformation into an investment & export hub for international markets. Uganda’s economic development policy tool for increasing and diversifying exports. The specific benefits are:

a) Promote export-led industrialization;

b) Create linkages of the domestic market with the international market;

c) Create quality and durable employment opportunities;

d) Increase Foreign Exchange Earnings; and

e) Enhance technology and skills transfer.

Free Zones bring enormous opportunities and benefits to the local communities where they are established, including;

a. Development of infrastructure: The areas hosting Free Zones will benefit from quality infrastructure such as roads, electricity, water, logistics services, business services and other similar infrastructure;

b. Creation of more employment, both direct and indirect;

c. Market for locally produced goods and foodstuffs;

d. Income generation for suppliers to the Free Zones;

e. Development of social amenities such as hospitals and schools;

f. Communities can also enjoy improved manufactured goods in instances where Free Zone enterprises sell some of their products into the local market;

g. The local farmers in the community will have an opportunity to engage in contract farming with the investors in the Free Zones and benefit from improved production methods and improved technology uptake;

h. The local communities will have an opportunity to participate in retail trade within Free Zones.

UFZA is committed to create an enabling environment for export-oriented investment. The specific services offered by UFZA are:

a. Regulating the Free Zones ecosystem in line with the Free Zones Act, 2014, the relevant provisions of the East African Community Customs Union Protocol and international best practices for Special Economic Zones;

b.Developing customised industrial infrastructure and production facilities to required international standards to attract export-led manufacturing and processing;

c. Providing information on opportunities for export-oriented investment in Free Zones;

d. Offering business facilitation and dedicated aftercare services in the acquisition of secondary licences, permits and approvals from other Government Ministries, Departments & Agencies;

e. Providing advisory services to the Government of Uganda on Free Zones development and related matters;

f. Developing appropriate policies and guidelines for Free Zones; and

g. Monitoring and evaluating activities, performance and development of Free Zones.

Both local and foreign investors are eligible to be licensed to invest in a Free Zone, provided they fulfill the following key criteria:

a. The business must be a registered company incorporated for the purpose of developing and operating a Free Zone/ Special Economic Zone in Uganda;

b. The company should be planning to export or exporting at least 80% of its annual output or services; and

- The activities of the company should create quality and durable jobs.

Existing companies manufacturing for export qualify to be licensed as Free Zones on condition that they meet the set requirements prescribed in the Act, one of which is to be registered for the sole purpose of operating in a Free Zone. They should demonstrate an increase in new investment, adoption of new technologies, expansion of jobs, and other criteria set by UFZA.

Section 25.3 “A developer shall be a company incorporated or registered in Uganda for the sole purpose of developing and operating a free zone”.

Investors wishing to join the Free Zones Scheme can apply for any of the following licences depending on the nature of business they want to undertake.

- Developers: These are issued with a Developer’s Licence. This Licence facilitates investors who are investing in infrastructure development like construction of industrial buildings and Warehouses, development of internal roads, landscaping and fencing, as well as provisions of utilities like power, water, sewerage systems and telecommunication lines.

- Operators: These are issued with an Operator’s Licence. The Licence facilitates the business enterprise to carry out any commercial activities which may include manufacturing and processing, breaking bulk, re-packaging and re-labelling.

- Managers: These are issued with a Manager’s Licence. The Licence enables the Business Enterprise to undertake the Management of a Free Zone.

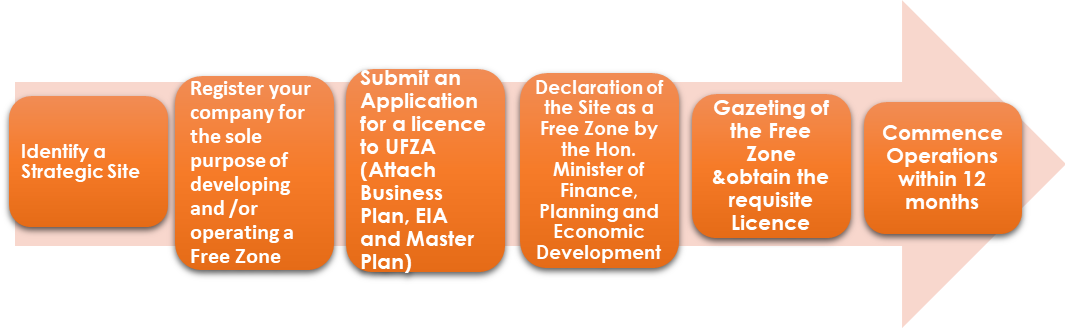

The following are the key steps to be followed in applying for a Developer, Operator or Manager’s Licence in Free Zones

The Authority handholds the Developer/Operator/Manager throughout this process

The Authority handholds the Developer/Operator/Manager throughout this process

The fiscal and non- fiscal incentives accorded to licensed Free Zones are intended to contribute to lowering the cost of doing business and improving Uganda’s competitiveness in the world market. The Government has provided for a package of incentives for Free Zone Developers, Operators or Managers which include:

a. Import Duty is exempt on plant and machinery, Spare parts tools, raw materials, Intermediate goods, construction materials, equipment, office equipment and supplies, and transport equipment in Free Zones;

b. 10-Year Income Tax Exemption for a Free Zone Developer and Operator;

c. VAT is exempt on any payment for feasibility studies, design construction services, construction materials, earthmoving equipment and machinery;

d. Excise Duty is exempt for construction materials for development or construction of a factory or warehouse;

e. No stamp duty payable on legal instruments executed by Developers and Operators of Free Zones e.g. debenture, lease of land, increasing of share capital and transfer of land;

f. Exemption from all taxes, levies and rates on exports from the Free Zones; and

h. Exemption on personal income of a person offering Technical Assistance under a Technical Assistance Agreement.

Non-Fiscal Incentives

Business facilitation and dedicated after-care services in the acquisition of Secondary Licences, Permits and Approvals from other Government Ministries, Departments & Agencies;

a. Logistical Goods may be transferred from the Port of entry directly to the Free Zone and Customs clearance done on site;

b. Serviced physical infrastructure facilities within the Zones (Public Zones); and

c. Centralized Customs inspection of buildings, premises, vehicles, vessels entering and leaving the Free Zone.

The Authority has the mandate to ensure compliance to the Law and Regulations as provided in the Act. Further, the law also enables us to work closely with the Uganda Revenue Authority (URA) to monitor the operations of the enterprises in the Free Zone and ensure that they adhere to the provisions of their respective licenses and customs laws.

The whole country is open for business; however, investors always look for areas where there are economic advantages such as affordable labour, agricultural activity, minerals and places with an abundance of raw materials that can boost manufacturing or value addition.

The investor has the prerogative to identify the export market but as the Authority, we would recommend markets where we have preferential market access such as AGOA, EU, and China. Investors also have access to the following markets; the Democratic Republic of Congo (DRC), South Sudan, the Asian Markets, the Middle East and Europe

Free zones generally fall into one of four categories: free ports, export processing zones, special economic zones, or industrial zones.

a. Free Ports, typically located near seaports or airports, mainly offer exemptions from national import and export duties on goods that are re-exported. Local services gain, though there is little, if any, value added to the goods traded.

b. Export Processing Zones go a step further by focusing on exports with a significant value added, rather than only on re-exports.

c.Special Economic Zones apply a multi-sectoral development approach and focus on both domestic and foreign markets. They offer an array of incentives including infrastructure, tax and custom exemptions, and simpler administrative procedures.

d. Industrial Zones are targeted at specific economic activities, say media or textiles, with infrastructure adapted accordingly.

According to the Act, the composition of the Board is such that the Chairperson and the Vice Chairperson are individuals from the Private Sector. This means that the Authority is directly linked to the Private Sector through its Board Chairpersons.

Further, the Law does not limit the application for operating Free Zones to only foreigners. Anyone who is interested in operating a Free Zone is free to apply and will be considered provided they meet the conditions spelled out in the law.

Private Companies can develop Free Zones. Section 29 of the Act states that “The Authority shall, in considering an application for a free zone license, require that the applicant demonstrates capacity to develop and manage a free zone under criteria prescribed by the Minister."

The law does not set any conditions to the minimum space or land that one requires to operate a Free Zone. Section 3.1 of the Act states that the Minister may, on the recommendation of the Authority, by Statutory Instrument, declare any building or area of land in Uganda to be a Free Zone.

- Uganda is an extremely resource rich country with great potential to develop into Africa’s top investment destination in Free Zones. With a predictable investment environment, a fully liberalised economy, good market access, a strong natural resource base and a commitment to the private sector by the government, the establishment of Free Zones will ultimately enhance economic growth and industrial development of the Country.

- Uganda is strategically positioned and is easily accessible to all our neighbours; Uganda provides easy access to DRC, Central African Republic, Kenya, Somalia, Mogadishu, Zambia and a whole host of other Central and Southern African countries.

- With government’s plans to develop the standard gauge railway which is going to link the whole of East Africa up to Ethiopia through S. Sudan and plans to develop the Airport to become a regional and continental hub, access to and from the country will be made a lot easier and will provide immense opportunities for the country.

- Uganda is peaceful and politically stable;

- Uganda has access to the regional markets of COMESA (400 million) and SADC (215million) as well as preferential access to the EU and US markets;

- Uganda has a relatively large labour force, most of them highly skilled and enterprising;

- Uganda has some of the best climatic conditions and natural resources in sub-Saharan Africa for agricultural production and for tourism

No, there is no duplication of roles. Our distinct mandate is to facilitate, license and regulate entities operating in Free Zones in Uganda. However, in aspects to do with investment promotion, customs control, trade and market promotional services, quality assurance and standards, we shall be working closely with the other Government Departments and Agencies.

Location: 6th Floor Communications House, Plot 1 Colville Street,

Tel: +256 417 722 600

Email: helpdesk@freezones.go.ug

Website: www.freezones.go.ug

Twitter: freezonesug

Uganda Free Zones Authority (UFZA) is a Government Agency that regulates and licenses Export Processing Zones and Free Port Zones for the purpose of creating opportunities for export-oriented investment and job creation.

Free Zones are designated areas in Uganda where duty free goods are stored, manufactured and or processed for export.

All domestic and foreign investors who export 80% and more of their enterprise output are eligible to invest in Free Zones.

"Since our region is endowed with a lot of natural resources, including reasonable supplies of fresh water, we need and we can work together to harness the opportunities" – H.E Yoweri Kaguta Museveni, President of the Republic of Uganda